To obtain the amount of claimable GST from qualified expense entries first ensure a deductible percentage is set in the Deductible field for each applicable expense category and that your. For COVID-19 tests for employees required to undergo Rostered Routine Testing RRT the Government will fund the.

Expenses For Which You Cannot Claim Itc Credit Under Gst

Input tax incurred on the medical expenses is claimable.

. For business owners who are GST-registered you may be eligible to claim the Goods and Services Tax GST incurred for your business purchases and expenses. INLAND REVENUE BOARD OF MALAYSIA. Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie.

It applies only to the tax paid on goods your purchases at. The GST incurred on. Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption.

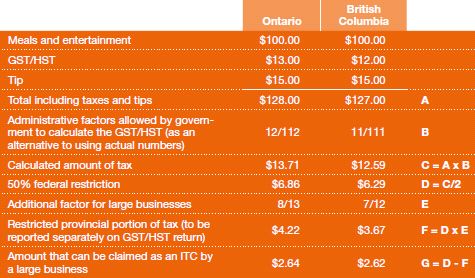

Conditions for claiming input tax. A medical expense of 10000 incurred with a GST of 600 Based on the. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax.

In Singapore and Malaysia BL GST code is an example of a non-claimable GST. Conditions for claiming input tax. 512 GST is also charged and levied on all.

Gst claimable expenses malaysia Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase. GST Goods and Services Tax is a local tax on products food and more. A imported goods except.

Gst claimable expenses malaysia. PART I EXPENSES PUBLIC RULING NO. TaXavvy Issue 7-2017 2 Public rulings on income tax treatment of Goods and Services Tax The Inland Revenue Board IRB has recently issued Public Ruling 12017 Income Tax Treatment.

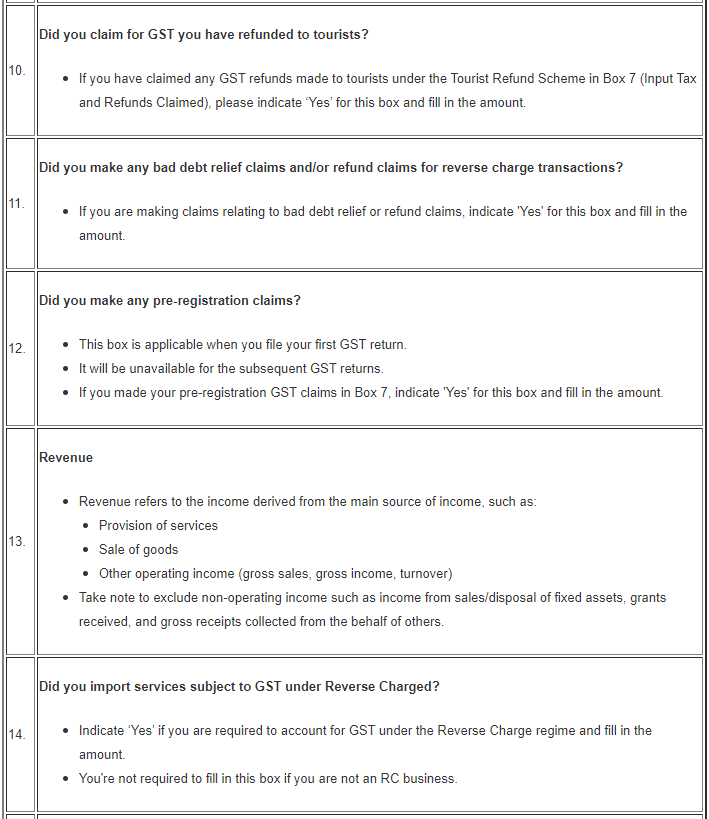

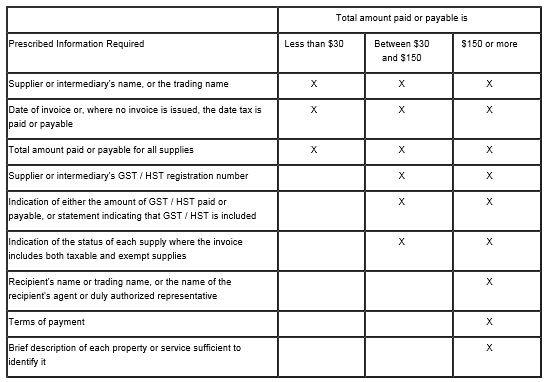

TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy. You can claim input tax incurred on your purchases only if all the following conditions are met. All output tax and input tax are to be accounted and claimed.

Conditions for Claiming Input Tax. You can claim the input tax. Purchases with GST incurred but not claimable Disallowance of Input Tax eg.

Tourists can claim this 6 tax under certain conditions. Lam Kok Shang and Gan Hwee Leng of KPMG preview the introduction of goods and services tax GST in Malaysia from April 1 2015 comparing it with the equivalent regime.

How To Claim Back Gst Gst Guide Xero Sg

How To Get Gst Refund Indiafilings

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

Lawyer S Billings How Much Gst Hst To Charge Thang Tax Law

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Sales Taxes Vat Gst Canada

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Goods Services Tax In Singapore

An Introduction To Malaysian Gst Asean Business News

Documentation Requirements For Claiming Input Tax Credits The Letter Of The Law Sales Taxes Vat Gst Canada

Malaysia Sst Sales And Service Tax A Complete Guide

Refund Under Gst All You Need To Know Quickbooks

What Is Gst And How Does It Work Infographic Xero Sg